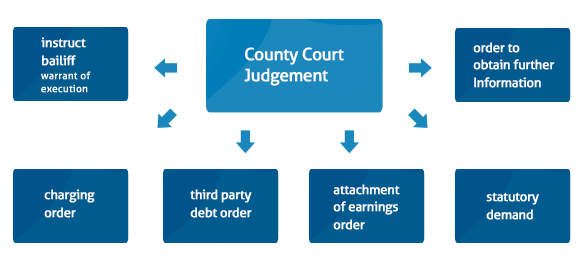

Obtaining a CCJ does not necessarily mean that the debtor will pay the money due and you may have to ‘enforce’ the Court Judgement. There are a number of ways in which to enforce a Judgement:

Briefly the enforcement methods involve the following:

An application is made to the Court for a ‘warrant of execution’. Once the warrant is issued, the court Bailiff will set a date to attend the property to seize the debtor’s goods up to the value of the CCJ and some additional costs. The goods can then be sold. The Court Bailiff’s time of attendance will depend on how busy the court diary is. For an additional fee a faster approach can be adopted on debts which have a value of £600 upwards, by transferring the debt to the High Court and instructing a High Court Enforcement Officer to visit the debtor within days.

If the debtor owns property (or land) then a charging order can be obtained. You, the creditor, will effectively become a mortgagee over the property and the amount of your charge (the value of the CCJ plus further interest and fees) must be paid by the debtor if he sells the property, which in certain circumstances you can force him to do. You will get your money if there is sufficient equity in the property to meet your charge after any prior charges from banks etc have been settled. This method of enforcement does not always produce an immediate result.

If the debtor is owed money from a third party such as a bank or building society (this can be in the form of savings or even money in a current account), or even an individual, then you can apply for a Court Order that the money is paid straight to you rather than the debtor.

Where the debtor is employed you can apply for a Court Order that the debtor’s employer must pay an instalment from the debtor’s earnings directly to the Court which will then pass that money on to you.

If the debtor owes you more than £750 you can serve a statutory demand upon him. If payment of the amount stated in the demand is not made to you within 21 days then you can start proceedings to make the debtor bankrupt or if the debtor is a company, to wind the company up. In some cases the statutory demand can be served without there being a CCJ in place. The threat of insolvency and bankruptcy proceedings is often a very effective tool in recovering a debt.

Where the debtor’s financial information is unclear you may apply to the Court to summon the debtor for questioning, on oath, about his financial affairs. The information obtained can be useful in determining whether you wish to pursue the debtor further and assessing which other enforcement method may be effective.